In the current high interest rate environment, many commercial real estate investors and developers are sidelining investment dollars while waiting for rates to drop. But continued economic volatility compounded by the threat of recession makes it difficult to predict when rates will start to decrease. Instead of waiting on the banks, investors should consider Federal Housing Administration (FHA) loans.

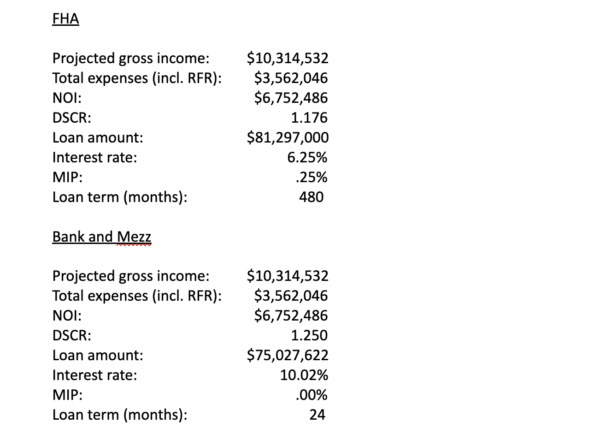

FHA loans are backed by the government and require a more involved application process, but the extra paperwork is well worth the effort. Consider a recent transaction Forbix completed for a 40-year FHA construction loan.

Because the FHA interest rate is significantly lower and the debt service coverage ratio (DSCR) constraints are less restrictive, the difference in loan proceeds amounts to $6,269,278. Translation: the bank/mezz route requires an additional six million plus in capital.

Another consideration is that a bank/mezze loan would require the property be refinanced after 24 months. What if construction is delayed or other issues arise like higher interest rates? The FHA loan provides a fixed rate with a longer runway – 40 years.

If interest rates drop, developers may be concerned with the FHA fixed rate option and stepdown prepayment penalty.However, they can refile the FHA loan without penalty utilizing an internal rate of return (IRR).

In the loan scenario above with the loan amount of $81M plus, the conventional rate would have to drop to 5.70%, which means the new FHA rate would be 5.20%. Using the IRR rule, the adjusted rate would be the average of the old FHA rate (6.25%) and the new FHA rate (5.20%), which comes to 5.98% (MI inclusive). The FHA scenario still saves $476,951 in interest per year for the duration of the loan compared to the bank/mezz option.

So why choose bank/mezz financing over an FHA 40-year construction loan for a multifamily property? If all permits are in place and construction needs to start right away, then developers may have to go the bank/mezz route. However, if there is some cushion, the long-term benefits of an FHA loan are a no brainer.

Forbix is part of a select group of commercial lenders licensed by the US Department of Housing and Urban Development (HUD) that are able to provide FHA loans as part of a full capital stack. For all our clients investing in multifamily properties, we provide full project assessment and analysis to arrive at the best financing options to achieve fiscal objectives within project parameters. FHA loans certainly deserve consideration to provide cost stability while accessing more in terms of loan proceeds and concurrently reducing monthly interest payments, thus increasing net operating income.

For over 25 years, Ross Ross has traded equity and interest-rate derivative products.