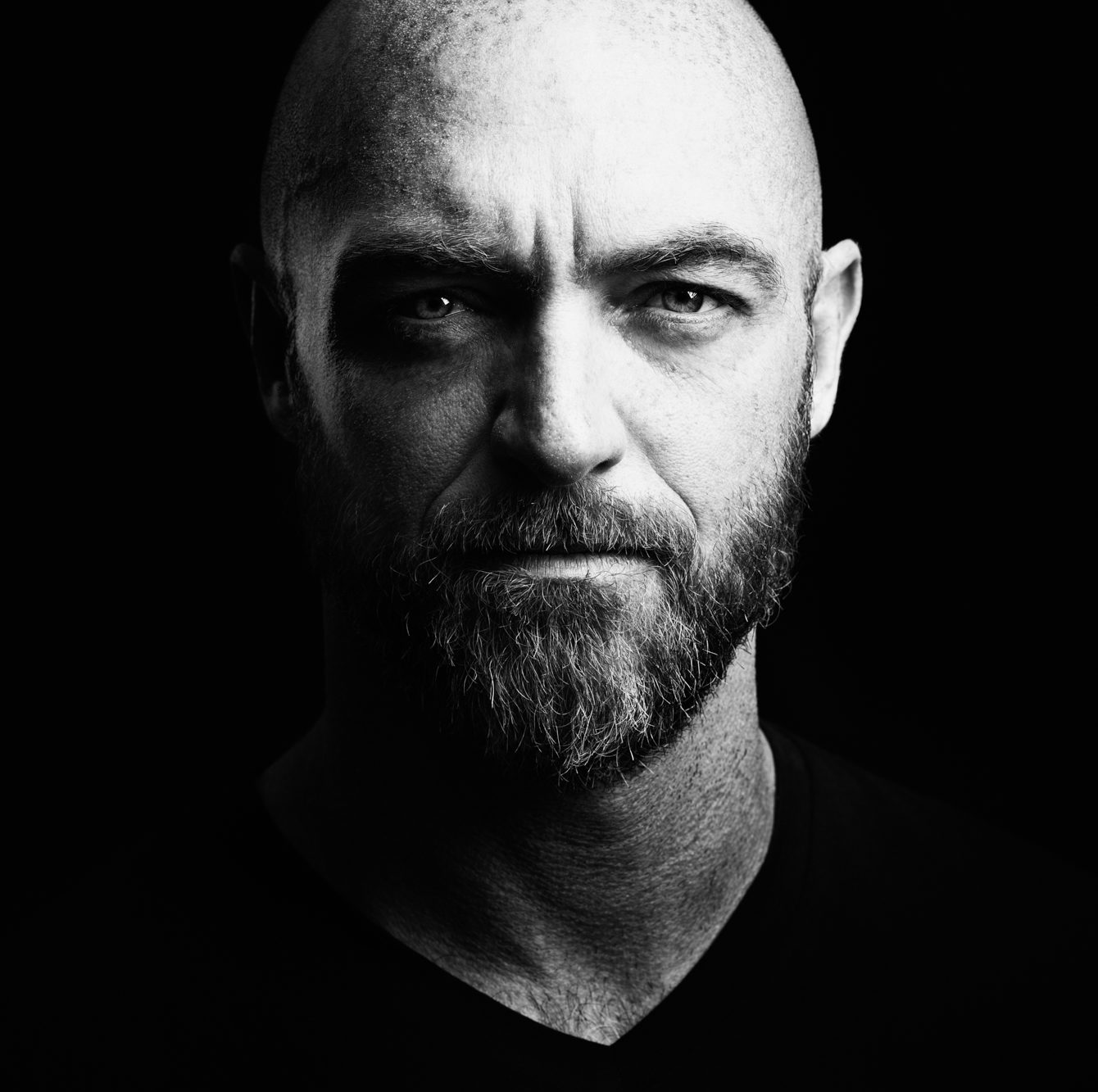

My father, Charles Schwab, started his company the year before I was born, so my earliest recollection of him is as a hardworking guy with a tiny company. He believed in himself and spent a lot of time working hard to grow the company. He insisted I work during the summers—my first job was a paperboy. His consistent guidance to me was, “I don’t care what you do in life, as long as you are a contributing member of society. Even if that is driving a bus.”

When I was around 14, I began accompanying him on his drives to work in San Francisco. He would go upstairs and I would go work in the mailroom. I credit my father for my desire to create something new and for having respect for everyone who works hard to achieve their goals.

However, I was not a great student. I was diagnosed with dyslexia and a healthy dose of ADD. When I was tested at age 11, my dad quickly realized he was also dyslexic. I loved math, science, and arts, but reading and writing were difficult. Rote memorization was nearly impossible. From ages 12–14, I attended a boarding school on the East Coast for smaller class sizes and individualized attention. I later attended USC for college but dropped out after three years. I studied political science mainly because I figured it was the easiest route to go. I now realize that I was too young. I should have taken a few years off to travel and figure out what I wanted to do, instead of just following friends to college.

If you asked most people if they are into action/adventure sports, they would say no. I want to change that.

By the time I left USC, I actually had a two-and-a-half-page résumé with experience ranging from working in a mailroom and construction work to valet attendant and assistant on a trading floor. For my first job after USC, I chose to work at a nonprofit where I was responsible for product procurement for homeless housing and substance abuse centers. In 1998 I went to work in the tech world doing business development for a startup called Creditland. That is where I fell in love with technology and started investing in companies that I was passionate about and that had great leaders.

In 1999 I decided to help open a restaurant in San Francisco called Charlie’s. That was my first experience raising capital and operating a business. It was a great and fun experience overall, but it ended up a being a serious education on the difficulty of the restaurant business. Notably, you must be there 24/7 to truly control it.

In hindsight, over the last 25 years, starting in business development, then moving to early-stage tech investing and emerging market real estate, and now developing a next-generation sports and wellness resort community, I feel like I have stuck with my basic beliefs and visions since day one: Things take a lot longer than you expect, but if you keep at it, your dreams will come true.

For instance, back in 2002, I first invested in TAE Technologies as an idea to change the world with clean and abundant nuclear fusion. Now, almost 19 years and 16 direct investments later, I believe we are on the cusp of achieving net energy production via nuclear fusion.

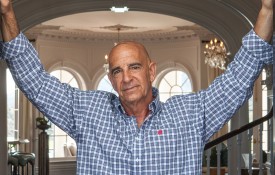

My personal interests have since also taken me in another direction. Around 10 years ago, my father mentioned to me that I should really consider investing in what I am passionate about, which kind of took me by surprise. Although I do love technology, and making the world a better place through it, I was falling in love with surfing, and that was becoming my real passion in life. My first reaction was, “Hey Dad, do you realize my real passion is surfing?” He said, “Yes, I know.”

To put it into context, my father at the time was 76 years old, and back when he was a kid, surfers were not exactly the most significant contributors to society. So I was surprised, but then realized he was onto something.

My first shift into investing into my passion was shortly after that, when I invested in a small surf resort in southeastern Indonesia called Boa on the island of Roti, which happens to be finally ramping up after all these years. “Island time” is what they call the slow pace of development. I had an old friend from USC who moved to Indonesia and really immersed himself, and we actually found the project together as I was out surfing the remote corners of the country.

The next move I made was in 2012 after visiting Martin Daly, from Indies Trader Marine Adventures, out on his remote Island called Beran, in the Marshall Islands, where he had pioneered a little island that was extremely remote, but had empty surf around it. I invested with Martin, and now we have a fully functioning resort that is amazing.

Then in 2013, I was invited to invest with Kelly Slater into the Kelly Slater Wave Company. It was kind of a selfish investment at the time, to help myself become a better surfer, since I had not grown up surfing. I figured if I had a perfect wave that I could practice on over and over, I could get better. Cut to today, it totally worked to improve my surfing, starting at age 40, which is kind of unheard of.

The shift to investing in sports-related startups is unique because not a lot of large funds have touched it to date. It’s been kind of a fringe idea that has been looked at as dangerous or unapproachable, and I want to make it more mainstream. If you asked most people if they are into action/adventure sports, they would say no. I want to change that. I call what I am doing adventure capitalism. But, like any business, the risk is failure and loss of capital. I am investing alongside friends and family, and we are all passionate about the work and believe in the future of surfing, wellness, and adventure sports.

My latest project is with my partner, Meriwether Companies, to build a next-generation sports and wellness resort community centered around a Kelly Slater Wave Company basin in La Quinta, Calif., called Coral Mountain. It will also feature a bike park with pump tracks for skateboarding, BMX, and mountain bikes; a skateboarding street course; lakes for e-foiling and standup paddleboarding; a full spa and fitness center including a biohacking facility; farm-to-table dining where we grow as much as possible on property; rock climbing; sports courts; kids’ camps; indoor golf simulation bays; and other amenities.

The other action-sports venture I recently invested in is called Natural Selection Tour (NST), founded by Travis Rice, the GOAT of backcountry snowboarding. The NST will start in 2021 with three events, first in Jackson Hole, then to Baldface Lodge in British Columbia, and will end in Alaska at the Tordrillo Mountain Lodge. I believe this will be the next version of the X Games, focused on backcountry snowboarding, captured and broadcast by drones, and will blow the minds of spectators.