Tara Bishop, MD, MPH, is a physician, medical school professor, startup executive, and health policy expert. Eileen Tanghal is an engineer and seasoned deep tech venture capitalist (22 years). Together, they launched a venture capital firm investing in companies using deep tech to improve healthcare.

Instead of connecting through networking or professional collaborations, the two crossed paths by chance, long before achieving their current accolades. The two ended up in the same sorority while studying for their undergraduate degrees at MIT. Bishop studying chemical engineering, while Tanghal was studying electrical engineering and computer science.

Through the dot-com bubble, expansion of Silicon Valley, and technological advancements in healthcare, they stayed in touch while growing their respective careers—and a college friendship led to a successful business.

Dr. Tara Bishop, MD, MPH

MIT DAYS

Bishop and Tanghal studied at MIT in the early 1990s, giving them the opportunity to be involved in the tech scene right as it was emerging. This ability to catch trends early will be a recurring theme in their story.

They also both joined the sorority’s leadership team, which may have marked the beginning of their journey leading together.

“We are used to recruiting smart, tech women because we started when we were 19,” Tanghal says.

Beyond this early recruiting experience, their time in college fostered a sense of ambition and camaraderie.

“I had these talented women around me and saw how we all worked, but also how we were personable and close and friendly,” Bishop says. “It never occurred to me, for example, to not strive for great things because of my time at MIT.”

Bishop and Tanghal also developed a bond due to their shared background. Both have Asian immigrant parents: Bishop’s family is from Sri Lanka while Tanghal’s is from the Philippines.

“When we got to college, we had grown up with the same sort of family life while also trying to tread between the two cultures that were both at home and surrounding us,” Bishop says.

The two became even closer after graduating, when Bishop was spending the summer in California before starting medical school and Tanghal was living there for her first job. Around this time, the dot-com craze was booming, and the pair even put together a business plan for an internet furniture company, like Wayfair, around the summer of 1998. While it never fully came to fruition, it was a sign of what was to come.

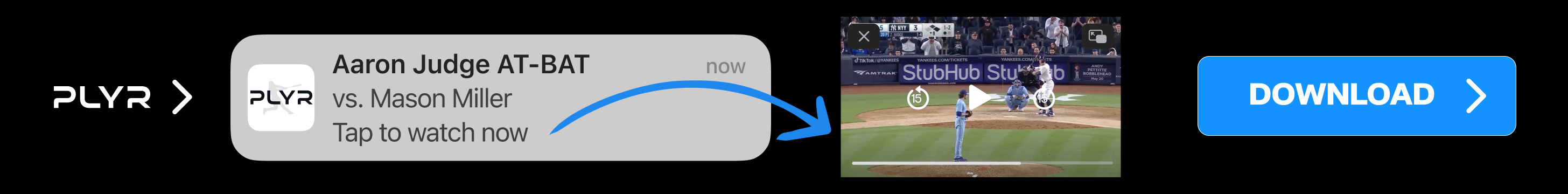

Bishop and Tanghal at HLTH in Las Vegas

MAKING MOVES IN EARLY CAREERS

Bishop and Tanghal have witnessed and been a part of profound technological changes in the world since the start of their careers.

In Bishop’s case, she joined the medical world when everything was still analog. “We had no electronic health records. We had nothing digitized in healthcare. We had a lot of issues with coverage and affordability in healthcare,” she says. “And I just remember feeling like I’m working in a really broken system.”

This realization inspired her to become an academic physician as well as a primary care doctor and teacher so that she can work on health services research to help to improve the system. She later moved to the private sector and consulting, focusing on issues of healthcare improvement like the Affordable Care Act.

“I loved being able to translate academic work into private sector work where you were on the ground working with people who were building new programs around state Medicaid programs and things like that,” she says.

Eventually, she became CMO of a startup health insurance company called Surest (formerly Bind), which she says is responsible for giving her the startup bug she still has today.

As for Tanghal, she worked as an engineer in Silicon Valley back when the startup scene was just beginning. Despite receiving job offers from larger companies, she decided to work at a five-person startup called PDF Solutions. The company was an innovator in design for manufacturing (DFM)—it made digital twins of manufacturing processes—which turned out to be something Black Opal Ventures invests in now, in a life sciences context.

“The reason why it takes so much money to get a new drug to market is that there just aren’t enough tools in the design for manufacturing parts,” Tanghal says. “Even today, you could discover a drug and have it work in clinical trials, but then when it goes to manufacturing, you don’t get all the yield. It’s a reason why some of these next generation of immunotherapies can cost individuals north of a million dollars .”

While Tanghal was at the company, it changed its business model to improve growth, which saw it go from half-a-million dollars in revenue to over $100 million. Ultimately, it went public, and like Bishop, Tanghal caught the dot-com bug.

She then went to business school between 2001 and 2003, and became a venture capitalist “by accident” after receiving a call to interview from VC firm, Amadeus. Despite it being her introduction to venture capital, she got the job.

“It’s very different from today,” she says. “Very few people had ever worked at a startup so that put me in a very different category.”

Eileen Tanghal

COMBINING TWO SKILL SETS

The dot-com bubble burst, and later the financial crisis came, but nothing could slow down Tanghal and Bishop.

Tanghal moved from London back to California in 2008, where she secured a job in corporate venture capital by reaching out to the head of Applied Ventures, the venture capital group of Applied Materials. She eventually became head of the group herself.

At Applied Ventures, she led her team to make investments in that could leverage the precision materials engineering expertise within the semiconductor into different fields – solar, lighting, energy storage and eventually healthcare and life sciences. Eventually, she made an investment in a company called Oncosallcope, which used imaging technology common in semiconductors to look at the esophagus to check for cancer. It was her first foray into healthtech investing.

“I remember telling Tara and other doctor friends and them just looking at me,” she laughs, recalling her early attempts to make investments without knowing about the area she was investing in.

Later, she found herself thinking she needed industry experts to better evaluate and invest in life sciences—and she just so happened to have a meetup with Bishop and her other sorority sisters around the same time.

“All my girlfriends were life sciences and healthcare people and they were looking for better tech,” she says.

“If anybody’s going to be able to bring these sides together, it’s us. That started the concept. I was like, if I’m going to start a VC fund, I’m going to get these women to do it with me.”

Bishop echoes her sentiments. “All of a sudden, our two roles are coming together, perhaps for the first time,” she says. “Eileen was talking about these really advanced technologies, and we were starting to see applications in the fields that we were working in.”

She first mentioned the possibility in late 2019, and Bishop and another friend were keen to get involved. Initially, it was a loose concept to do angel investing, but it soon evolved further.

The pair received an opportunity to pitch to a previous contact, who wanted to anchor the fund . At the time, they both had full-time roles, but it was a once-in-a-lifetime opportunity, and they grabbed it with both hands.

Despite the broader global uncertainty at the time (it was early 2022), they were fortunate enough to continue to gain traction.

The fund brings the worlds of emerging technology and healthcare together, leveraging the strengths of the team’s backgrounds.

“Sometimes I get overexcited about the tech. And Eileen will be like, there’s more cutting-edge tech,” Bishop says. “And then on the flip side, she might get excited about a company. And I’ll say, I just don’t think there’s a commercialization model.”

In their first fund, they’ve made strategic investments in companies that are propelling innovation in oncology, neurology, obesity, and infertility. These investments include FlyteHealth, Conceivable Life Sciences, Optellum, Hyro, Empatica, TigerGraph, Outpace Bio, and Blaze.tech.

They’re currently in the process of developing programs to help them scale further, such as a scout program to leverage a broader network and a fellows program to bring more people into VC.

Bishop reflects on how far they’ve come from the dreams of their college days: “I think the evolution has been our ability to build a long-lasting firm from just an idea.”