THE OPPORTUNITIES

What hasn’t changed?

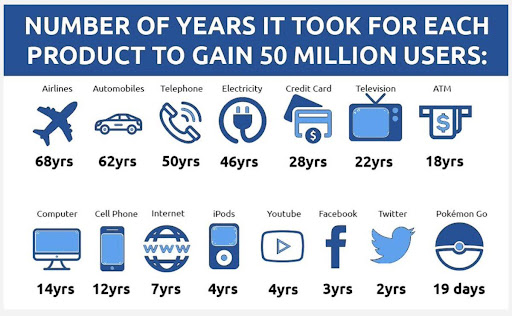

Even though growth stocks have been suffering lately, the pace of innovation is accelerating. COVID accelerated the magnitude and importance of technology as a component of society. As the digital foundation of the global economy expands rapidly, it is enabling disruption in a matter of months. Microsoft CEO Satya Nadella said that, due to the COVID pandemic, two years’ worth of digital transformation took place in just two months. Businesses can now reach millions of users in the shortest time ever. The graphic below shows that it took airlines 68 years for their product to reach 50 million users. Thanks to digitalization and innovation, modern products like social media platforms and online games are reaching the same amount of users in a small percentage of that time.

Source: Earthly Mission

As a result, disruptions can now affect business almost overnight, as newly formed innovators scale from $1 million to $100 million in sales faster and faster (see chart below).

Source: Bessemer Venture Partners

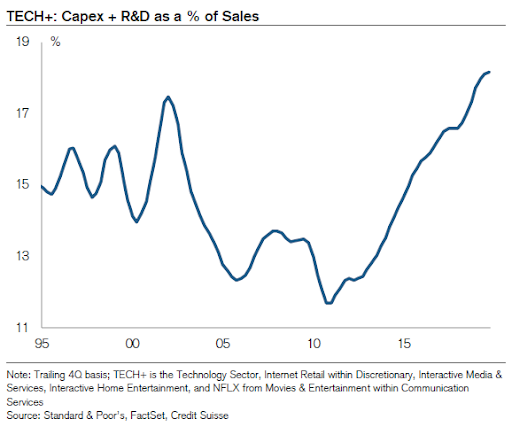

Moreover, the capital expenditure (capex) spending on IT and R&D has accelerated in recent years. The chart below suggests that, within the tech industry, capex spending plus R&D as a percentage of sales has approached an all-time high of 18%.

The pace of innovation is accelerating and tech reinvestment is growing, yet most innovative companies are only just beginning to capture small portions of their total addressable markets. Thus, these runways are immense and ripe with opportunity. It is our opinion that there is still an exponential amount of growth to be unlocked in sectors such as cloud software, AI, and machine learning.

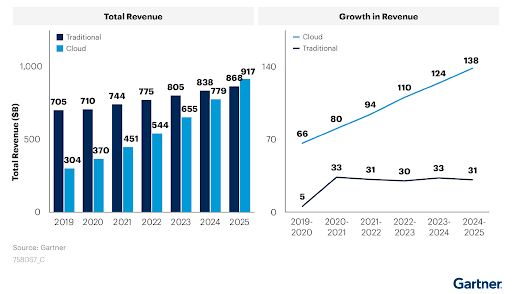

The cloud industry, for example, which includes software-as-a-service as well as infrastructure-as-a-service, currently represents only a small portion of the entire enterprise IT spending per year—approximately $234 billion of a $3.9 trillion enterprise IT industry. Cloud spending is set to occupy a larger portion of IT budgets over the next five years, taking overall cloud penetration significantly higher. Based on Gartner’s research, “enterprise IT spending on public cloud computing, within addressable market segments, will overtake spending on traditional IT in 2025”—a catalyst that will significantly propel cloud market penetration. “Demand for integration capabilities, agile work processes, and compostable architecture will drive continued shift to the cloud, as long-term digital transformation and modernization initiatives are brought forward to 2022.” The chart below from Gartner shows that expected growth in cloud revenue is on the rise and set to continue at a steep rate, whereas growth of traditional IT revenue has plateaued. This indicates that we are still in the early stages of the shift to cloud, with significant growth to be captured. This is just one example of an industry within the innovation space that is on a fast track of immense potential.

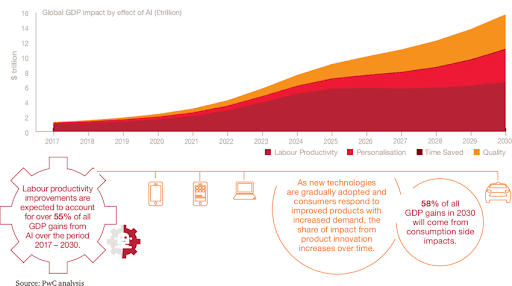

In summary, we believe we are in the early stage of the most disruptive innovation cycle in technology ever. The chart below shows that the AI-driven revolution has contributed around $2 trillion to global GDP in 2020, and has the potential to contribute up to $15.7 trillion by 2030. Specifically, labor productivity improvements are expected to account for 55% of all GDP gains from AI over the period from 2017 to 2030. AI penetration into the global economy has just begun.

DISLOCATIONS = OPPORTUNITIES

We have illustrated that most investors tend to focus on short-term cyclical events and allow them to dictate investment decisions. However, what they have ignored is just how impactful these innovative technologies will be to humanity’s everyday life. It’s a tug-of-war between short-term market sentiment versus deeply embedded innovation themes that will positively impact every facet of our lives.

Amazon is an example of a company that was not always a sure thing. Early in its existence as a public company, many Wall Street analysts had trouble understanding how the company was going to make money. Founded by Jeff Bezos, it evolved into an online e-commerce company that carries every product from A to Z. In the early days, Amazon had negative earnings every year as it kept reinvesting capital in the company to develop new products. In 2001, the dot-com bubble nearly destroyed many Internet companies, but Amazon survived and became a huge player in online sales. The stock, however, dropped 85% from the beginning of 2000 to the end of 2001, and then recovered 386% over the next two years. The company then expanded into the cloud service business via AWS and other areas such as groceries (Whole Foods) and streaming services (Prime Video). Through June 16, 2022 (the recent market bottom), Amazon’s stock was down 38%. However, as of the same date, the annualized return since the inception of the stock (May 15, 1997) is 32% compared to just 8% for the S&P 500.

This highlights that even the most promising companies go through tough periods such as the dot-com bubble and the global financial crisis, yet can emerge as long-term winners thanks to their commitment to innovation and continued reinvestment into the business.

We understand with social media platforms such as Twitter and channels like CNBC being the main source of news and knowledge for the vast population, it is very easy to focus on controversial headlines that tend to be attention grabbers. People rarely have the time or patience to spend an hour or two reading a book or white paper like this one. If you turn on news channels today, you will probably feel as though the world is about to end—another COVID wave, the war in Ukraine, China lockdowns, inflation hits another high. However, what media outlets typically do not report is the recent drug invented that could cure a fatal disease or new software being launched that will dramatically increase workforce productivity—again, the list goes on. When there is too much pessimism in the market it tends to go to an extreme level. As Howard Marks mentioned in his memo, we need to realize that there are limits to negativism just like there are limits to optimism.

CONCLUSION

Challenges, dislocations, and opportunities represent cogs in a wheel that repeat themselves at various stages of economic and innovation cycles. As we have steadfastly repeated during the past several years in these articles, all three are in play now and the winners and losers will be defined by how you interpret and act during these well-defined dynamics.

Higher interest rates, inflationary concerns, inflated valuations, limited access to capital, and the long list of geopolitical events occurring around the world suggest more difficulty ahead. We are not in the business of handicapping how and when these challenges begin, accelerate, or end, but we are very much interested in understanding the macro environment in order to make sound, long-term investment decisions on behalf of our clients and our own investable capital.

The many “dislocations” are typically what creates opportunity. The most glaring ones today relate to how the market is treating all technology companies the same, regardless of their growth rate, balance sheet, management teams, barriers to entry, or cash position. Indiscriminate punishment of all companies in a particular sector or industry is par for the course during “blow-off” periods of market corrections. We are seeing this in play now and look forward to seeing the companies that thrive after experiencing much adversity and market uncertainty.

As advisors to company founders, entrepreneurs, private business owners, and others who have played an integral role in building some great businesses, we have had a front-row seat witnessing why and how some businesses succeed and some fail. In our role as wealth managers, our responsibility is centered on making sure our client allocations are positioned to benefit from this unprecedented wave of innovation without subjecting the capital to undue risk.

SOURCES

- Gillham, Jonathan. (2017). The Economic Impact of Artificial Intelligence on the Global Economy.

- How Big Tech Won the Pandemic – The New York Times (nytimes.com)

- The Fed’s Liquidity Confusion | AIER

- One Year Into the Pandemic, Big Tech Is Bigger Than Ever – Bloomberg

- After Covid-era boom, newly public tech stocks hit first major hurdles (cnbc.com)

- S&P 500 doubles from its pandemic bottom, marking the fastest bull market rally since WWII (cnbc.com)

- Pandemic-stocks: Covid drove massive market gains — what happens next (cnbc.com)

- Tech Stock Valuations, COVID-19, And The Efficient Market Hypothesis: Enough Already | Seeking Alpha

- Covid has made biotech companies the hot new tech sector as investor demand drives record IPOs (cnbc.com)

- Microsoft CEO: “We have seen two years’ worth of digital transformation in two months” – DCD (datacenterdynamics.com)

- Howard Marks Memo to Oakree Clients: Conversation at Panmure House

- Number of Years It Took for Different Products to Gain 50 Million Users (earthlymission.com)

- Bessemer Venture Partners. (2020). State of the Cloud 2020. https://www.bvp.com/atlas/state-of-the-cloud-2020

- Credit Suisse. December 2019. U.S. Equity Strategy Navigator. https://research-doc.credit-suisse.com/docView?language=ENG&format=PDF&sourceid=em&document_id=1081975521&serialid=4d5G6pkBcRgbhbjfabXIVlkbBEv40ngzw0LDTOzVpX0%3d

- Gartner Says More Than Half of Enterprise IT Spending in Key Market Segments Will Shift to the Cloud by 2025

DISCLOSURES

The Standard and Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Individuals cannot invest directly in an index.

NASDAQ Composite Index (NASDAQ): A market-value weighted index that measures all NASDAQ domestic and non-U.S. based common stocks listed on The NASDAQ Stock Market.

The Russell 1000 Growth Index (R1000 Growth): Measures the performance of the Russell 1000 companies with higher price-to-book ratios and higher forecasted growth value.

Oppenheimer & Co. Inc. does not provide legal or tax advice, but will work with your other advisors to assure your needs are addressed. The opinions of the author expressed herein are subject to change without notice and do not necessarily reflect those of the Firm. Additional information is available upon request. Investors should review potential investments with their financial advisor for the appropriateness of that investment with their investment objectives, risk tolerances and financial circumstances.

©Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 4920063