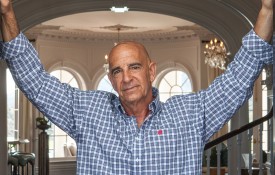

American businessman and angel investor turned VC Kelly Perdew first entered the public eye as the winner of The Apprentice: Season 2. Today, his reputation is built on the LA technology investment scene. A Southern boy at heart who spent most of his childhood in Kentucky and Florida, Perdew is now ensconced in a Southern California lifestyle near the beach that includes launching and investing in early-stage technology ventures.

From earning his degree at the United States Military Academy at West Point to his newest role as co-founder and Managing General Partner of Moonshots Capital–which specializes in funding startups helmed by military veterans–Perdew is eager to give back to the Los Angeles community he calls home by helping young entrepreneurs succeed.

The oldest of five brothers, he attended high school in Cheyenne, Wyo., where he played sports and worked at McDonalds during the summers. Appointed to West Point by former Vice President Dick Cheney, Perdew became the first in his family to go into the military. Three of his four brothers would follow in his footsteps – one Army and two Navy.

Upon graduation, he became a military intelligence officer. Commissioned as a second lieutenant in the Army, Perdew completed both Airborne and Ranger training and was stationed at Fort Ord in Monterey, California.

An Emerging Entrepeneur

Perdew attended business and law school at UCLA after completing his military service, earning his J.D. and M.B.A. in 1996. As he interacted with more and more bright people during this time, lightbulbs began to go on, leading him to anticipate an entrepreneurial future.

As a summer intern with the Century City law firm Gibson, Dunn & Crutcher, Perdew had an epiphany while working on the documentation for a large business acquisition deal at the printers. He decided he wanted to be an owner of the successful firm involved in such negotiations, not merely a legal service provider.

Perdew learned a hard lesson when he launched his first startup, ImageTel International, in 1994 during his fourth year of law school. He raised $500K from family and friends to fund the company, but his credit card debt quickly approached $80K in the process.

We understand and lean in more when one of the co-founders of a venture needing funding is a military veteran … It’s easy to determine whether I want them in my foxhole or not.

To get out of debt, he worked for a couple years with Deloitte Consulting, then dove right into a new startup, eTeamz, which he in turn sold three years later to Active Networks.

“I’ve been building companies, investing in companies, basically since 1994 here in Los Angeles,” he says.

When Perdew read Richard Kiyosaki’s book Rich Dad’s Cashflow Quadrant, he was inspired to begin investing (both his time and money) in other entrepreneurs, knowing that he would need to diversify to attain the returns he sought. To date, Perdew has invested in more than 70 companies—as an angel, as a syndicate lead angel and, now, through his committed VC fund.

The Winning Apprentice

After being encouraged to audition for the second season of The Apprentice in 2004, Perdew won the contest and moved to New York to work in Donald Trump’s offices for 14 months. During this time, he studied up on real estate and the media, writing the book Take Command: 10 Leadership Principles I Learned in the Military and Put to Work for Donald Trump.

Perdew came back to LA and continued to invest in early stage technology as an angel. One of his first angel checks was for ZAG, Scott Painter’s company, which became TrueCar.

“One of the fascinating things about being an investor…is that you’re absolutely going to see some great deals, and you’re absolutely going to invest in some things that don’t work out, but that’s part of the excitement around early stage,” Perdew says.

He has invested in and worked with industry-leading companies in various capacities, including TrueCar, Pandora, Linkedin, RideScout, Harvest.ai, Scopely, Bitium, DuMont Project–which has been a passion for the past decade–and many more. One of the LA-based companies Perdew wrote the first check into, Bitium, was purchased by Google in October 2017.

Perdew professes great empathy for entrepreneurs and strives to impart his lessons learned to young, aggressive, knowledgeable, savvy entrepreneurs.

One of the fascinating things about being an investor…is that you’re absolutely going to see some great deals, and you’re absolutely going to invest in some things that don’t work out, but that’s part of the excitement around early stage.

“Having now served in so many board capacities, continuing to be an operator myself—ten companies I’ve either founded or been a team member of, two learning experiences, five exits, and three companies still operating profitably—there’s so much I’ve learned from dumb luck combined with experience,” he says.

Shooting for the Moon

Perdew and his Austin, Tex.–based investment partner Craig Cummings, also a West Point alum, formed Moonshots Capital in 2014. An investment syndicate 430 investors strong, it has deployed nearly $11M to date.

After determining that the military is the only organization that consistently funds leadership development, the two decided to prioritize investing in startups led by military veteran entrepreneurs. More than 70% of their projects are associated with military veterans, who are increasingly undertaking early stage technology ventures.

“We understand and lean in more when one of the co-founders of a venture needing funding is a military veteran,” he says. And because these leaders are vetted and share a common vernacular that facilitates trust and communication, he adds, “It’s easy to determine whether I want them in my foxhole or not.”

As Moonshots Capital launches as a venture fund, buzz is already building, with more than 100 deals coming through monthly. With plenty of ammunition for new targets for investing, Perdew is poised for orbital success.

Photos by Tim Hans