“I think if you asked 100 entrepreneurs that sold their companies, 99 are going to tell you that they could’ve pushed it further,” Jason Nazar says. “[There’s always] some level of doubt or regret or thought [that] they could’ve done more.”

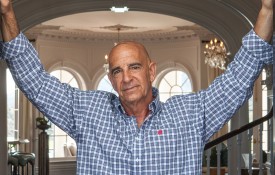

Sitting in the “Relax and Recharge Lounge” at the 2015 LA Tech Summit at the Fairmont Hotel in Santa Monica last November, where he moderated a “Shark Tank” panel earlier that afternoon, Nazar takes a moment to reflect. Yet the nature of the conversation brings him back to only a few months earlier, when Intuit made the decision to shut down Docstoc, the document service company it had acquired back in December 2013.

“I certainly fit into that group as well,” he says referring to the difficulty he had pulling the trigger on selling his company. “But overall I’m really proud of the company we built, the customers we served, the team we built, the experiences we had, the return we provided for investors, and so that’s not something I choose to look back on with regret in any way. I’m really appreciative for all it afforded all of those stakeholders – including myself.”

Docstoc was the third company founded by Nazar, who describes himself as a serial entrepreneur at heart. While all three previous companies were in the consumer Internet industry space, his new company, details of which were under wraps at press time, will be in human resources. An undergrad at University of California, Santa Barbara and a business and law student at Pepperdine University, the LA native is a shining example of the city’s technological depth, breadth, and growth — whose mentors include his investors along the way and a tenured generation of Los Angeles’ serial entrepreneurs such as Brian Lee and Jeff Stibel.

“We’re not quite as active as Silicon Valley, which nobody in the world is,” Nazar acknowledges, “[but] it’s probably the second or third biggest tech market in the world having access to engineers and people that have already been in tech for two generations now that are here to support you.”

“…you can put something out early on that just kind of strikes a chord with customers and they’ll do a lot of the marketing and growth for you if that’s the case.”

While he stopped short of revealing the name of his new company, he confirmed the entity name is “Crew32” and his fellow co-founders are George Ishii and Yadid Ramot. Ishii was one of the core programmers at Paypal back in the early 2000s, and Ramot was a co-founder and CTO at Invested.in. Nazar will serve as CEO at the new company, which has already raised $6M to date and will officially launch in mid-January.

“If you really focus on the product to start and if you go through enough iterations,” Nazar says, “you can put something out early on that just kind of strikes a chord with customers and they’ll do a lot of the marketing and growth for you if that’s the case.”

As the conversation draws to a close, the 39-year-old entrepreneur invokes the tech numbers, which validate his point.

“After the bubble popped there were probably 20 to 30 companies I could count on my hand that people knew in tech in Los Angeles overall,” Nazar says. “You could do these small dinners with 20 people and it seemed like [that covered] most of the people [who] were in tech. Today, you need a conference of 1,500 people here today.”