When I had the opportunity to invest in OpenAI a few months ago, my initial thought was that it was potentially a no-brainer. At that time, there was much hype about AI and this company in particular. After all, it was pretty much solely responsible for bringing the idea of AI innovation to the general public. Most of the gains in stock indexes this year are almost solely due to AI.

However, once I looked closer at the company’s governance structure, I became a lot less interested and passed on the opportunity. The thing that bothered me most was the weird organizational control and potential for massive conflicts of interest, particularly after commercialization became a focus.

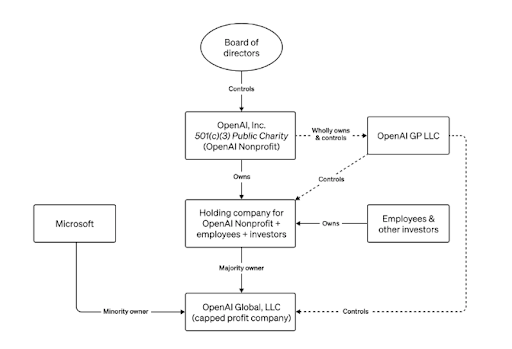

Matt Levine of Bloomberg wrote a great opinion piece this week on this very subject, and it validated my original concerns. He summarized the control structure in a simple diagram:

Diagram of OpenAI control structure

My primary concern with this is that the board of directors controls the public charity, which basically controls the entire company, including the $13 billion+ stake that Microsoft now owns. Additionally, the company has self-imposed limits on the amount of profit that can be returned to shareholders versus the charity. This is a huge red flag. Investors may be hesitant to opt into this scheme due to the lack of control they have over the company’s decision-making process and the potential limitations on profit returns. The board’s control over the public charity, coupled with the restrictions on shareholder returns, raises concerns about transparency and potential conflicts of interest. This setup may deter investors who prioritize maximizing their financial gains and prefer a more traditional ownership structure.

It’s one thing to want to ensure the greater good of humanity, but possibly quite another to maximize profits for shareholders.

Sometimes these goals are not mutually exclusive; however, why saddle your company in this way, to say nothing of the potential governance problems down the road that have surfaced as of November 24 with the firing of Sam Altman, the visionary behind OpenAI.

Although the board provided no explanation, conventional wisdom holds that there was a disagreement regarding Altman’s desire to continue commercializing AI with less emphasis on the internal “good of humanity” brakes that the board preferred.

By now, we know that a majority of OpenAI employees have signed a letter demanding that Altman be reinstated, which apparently has happened.

Regardless of the outcome, the board handled this situation horribly by providing the investors—including Microsoft—with little information and no advance warning. The board has potentially destroyed billions of dollars of value in the process and now lacks credibility with investors. And make no mistake, the company needs investors to fuel the massive capital required to develop AI solutions.

What can be learned from all of this? As investors, we need to pay attention to the offering documents and learn everything we can about potential portfolio companies, including their governance structure, which normally isn’t this complicated.

If it looks weird, or strikes you as complicated, overly favorable to executives or investor groups, or throws up roadblocks to a future profitable exit, stay clear.

For corporate board members, it should be an obvious requirement to understand the juxtaposition between all stakeholders, including your investors. And, for goodness sake, think things through before acting. Investors hate surprises, particularly when they come from management. Always be transparent and honest with your investors and be proactive about communicating any potential issues or risks. Finally, make sure any decisions you make are in the best interest of the company and its shareholders.

I’m sure that OpenAI will find a way to resolve its problems, and it may still become a very profitable investment; however, the team has a lot of work to do, starting with the board and potentially removing the charitable control issue.

In my opinion, the company needs to decide which group will effectively control the company. Should it be the nonprofit or should there be a total reorganization and a revised charter?

At this point, with the billions of dollars invested in the firm, you would think that it would be focused on how to keep investors happy and instill confidence in the investment community, as well as confirming to what degree it has a responsibility to humanity.

Additionally, it is crucial for the company to carefully consider the potential consequences of each option. While maintaining nonprofit control may align with its original mission, a total reorganization and revised charter could bring fresh perspectives and strategies to drive growth and profitability. Balancing the interests of investors, societal responsibility, and long-term sustainability will be pivotal in making a well-informed decision that ensures both financial success and a positive impact on humanity.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm based in Dayton, Ohio.