In March 2021, Christie’s auctioned off an NFT called “Everydays: The First 5000 Days” by digital artist Beeple for a record-breaking $69 million. The sale was a precursor to an eventful 2021, as “NFT” became a buzzword that mingled with “crypto” and Web 3.0. The technology peaked in Q4 of that year, with yearly sales soaring to $17.7B, 200 times the yearly sales in 2020.

Now, exiting last year’s peak, analysts and collectors attribute the trend to several factors, ranging from the war in Ukraine to increased regulation by the Securities and Exchange Commission.

Let’s dissect what’s happened so far in the NFT space.

What Is an NFT?

NFT stands for “non-fungible token.” In all economies, goods and services are either fungible or non-fungible, “fungible” being another word for “replaceable.”

Fiat currencies are fungible. A U.S. dollar can be replaced with another dollar, and its intrinsic value does not change. On the other hand, a baseball that you happen to catch at a championship game is non-fungible. The championship baseball is irreplaceable because of the personal experience attached to it.

Combining this distinction with “tokens,” which refer to digital currency such as Bitcoin or Dogecoin, an NFT is a financial tool that confirms unique ownership of a digital asset.

Why Are NFTs Innovative?

Digital assets themselves are nothing new. However, NFTs bring three innovations to assets on the internet:

- Uniqueness: Two NFTs can be visually identical, similar to two baseballs, and still reflect different values due to their unique coding within their blockchain database.

- Limited Supply: Traditionally, when purchasing digital media, such as an app on the Apple Store or a movie on Amazon, you’re able to purchase the media an unlimited number of times. NFTs, on the other hand, create digital scarcity. You may only be able to purchase a few of a given asset before it sells out, which can be a huge value driver.

- Trackable Ownership: NFT ownership is tracked on a blockchain platform, which creates opportunities for new online business models. For example, businesses and artists can manage NFTs so that they get a percentage of proceeds upon each resell. This means they can reap residual benefits if their product circulates on the market or increases in value.

Where Did NFTs Come From?

The history of NFTs is more intricate than most people realize. NFTs are a byproduct of the cryptocurrency industry. More specifically, the powerhouse behind NFTs, blockchain technology, started in 2008 with the release of Bitcoin’s whitepaper.

What Is Blockchain Technology?

Blockchain technology is essentially a replacement for big banks. Throughout modern history, banks have been far from perfect, with numerous examples to choose from: Bank deregulation in 2008 essentially caused the Great Recession, and Wells Fargo made national news in 2016 for creating millions of fraudulent bank accounts.

Blockchain technology represents an attempt to remedy these issues. Instead of centralized banks and governments managing transactions, a decentralized network of computers is responsible. This reduces fraud and increases financial security.

Photo by Pierre Borthiry on Unsplash.

In 2012, soon after the emergence of blockchain technology, mathematician Meni Rosenfeld released a paper introducing “Colored Coins”—a way to express and manage ownership of physical assets using the Bitcoin blockchain. The project did not receive much attention because Bitcoin was still too limited to implement Colored Coins.

In 2015, Ethereum became the second blockchain innovation for NFTs. In addition to Bitcoin’s blockchain features, the Ethereum blockchain also provides smart contracts—code connected to a digital asset that confirms the asset as unique, traceable, and verifiable. These smart contracts are the essential component of NFTs, and the majority of NFTs are linked to the Ethereum blockchain.

NFTs as Art

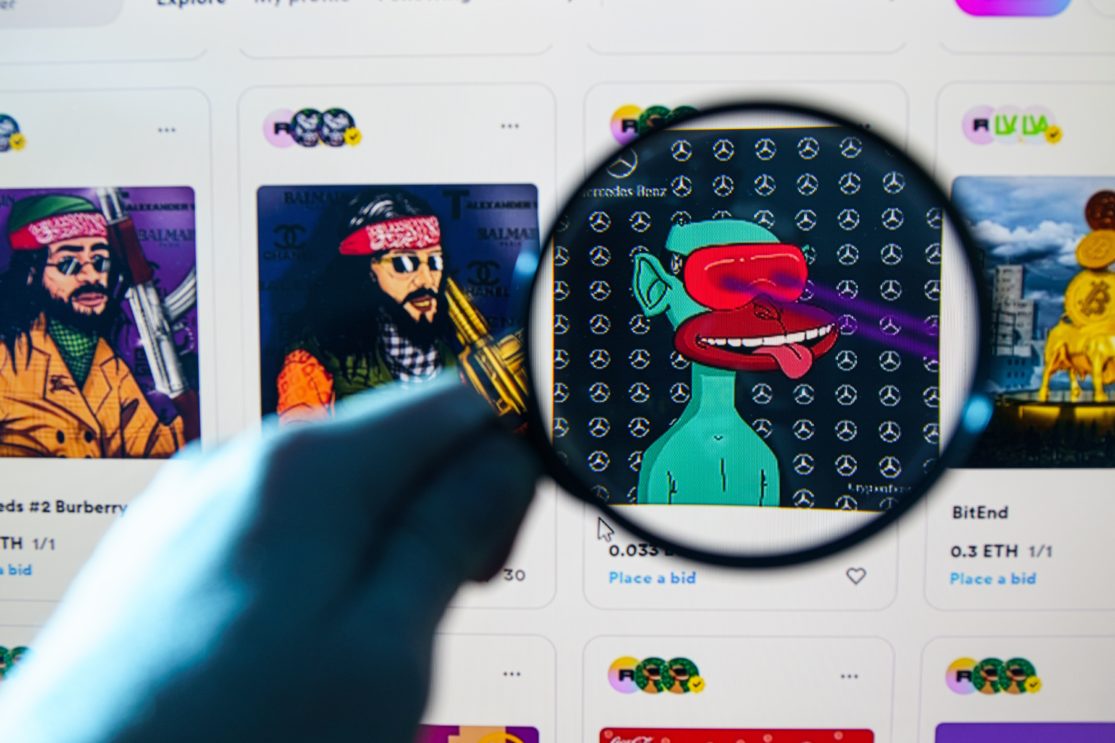

Trading NFT Artwork in Marketplaces

Anyone can buy and sell NFTs via online platforms such as SuperRare, Zora, or Nifty Gateway. The largest NFT platform is Opensea, which holds over 90% market share and has recently been valued at $13.3 billion.

Artists can “mint” their digital art on these platforms, thereby making them unique, and then auction the tokenized artwork for cryptocurrency, typically ether (ETH). Enthusiasts and collectors then bid on the art and eventually claim digital ownership of the piece. Owners commonly attempt to resell the art for a higher price. This process of trading art for ETH induces a cross-market interest: In a similar fashion to day trading, crypto investors who feel neutral about the subjective value of art are still interested in trading NFTs for a potential ETH profit. In this vein, NFT marketplaces help creators build their portfolios, earn trackable revenue, and reach an alternative market segment.

NFTs Perpetuating Art Theft

While some artists have managed to make millions of dollars by minting and selling NFTs, others face theft as an outcome. Throughout 2021 and continuing into 2022, creators and illustrators of original artwork have discovered—often too late—that someone has stolen their art, minted it on an NFT platform, and sold it for a profit. In late January, Opensea tweeted that 80% of the items removed from their site are plagiarized.

The original tweet said 80% of NFTs minted with our lazy minting tool violate our terms of service. That isn’t right. 80% of NFTs *we remove* for violations are lazy minted.

— OpenSea (@opensea) February 16, 2022

This tweet came shortly after the execution of Opensea’s initial solution to theft, which involved limiting the number of NFTs their users could mint for free. The solution was modified after backlash from the marketplace community.

Even more recently, Nike has sued artists for using their branding in NFTs. This sudden boom of technology within the art platform has created financial conflicts of interest in terms of brands and intellectual property—and NFT marketplaces continue to scale and capitalize with little regulation.

NFTs in Gaming

In the gaming-finance (GameFi) sector, NFTs are interpreted as in-game buffs, customization items, virtual land, or tradable assets within a microeconomy. The incorporation of NFTs into video games has created a “play-to-earn” (P2E) gaming model in which players can earn in-game rewards that have real monetary value.

For example, Axie Infinity, the most popular P2E game, has an estimated 2.7 million average daily users. The game takes inspiration from Nintendo’s Pokémon franchise and has players collecting, battling, and trading axolotl-type creatures called “axies.” Players who win battles are rewarded with “smooth love potion,” or SLP, which can be traded for cryptocurrency. The SLP earnings ratio has been a large motivator for gamers in Ghana and the Philippines, where crypto has a significant exchange rate.

Axie Infinity was developed in 2018 by Vietnamese game studio Sky Mavis. Image source: Niko Partners.

In a similar vein to their presence on art platforms, GameFi NFTs have been praised for allowing average gamers to earn income without being particularly influential or committed. A survey by Interpret found that over 56% of gamers are interested in earning NFTs through gaming.

Yet, gamers seeking a full experience can still face cumbersome entry barriers in the new P2E model. Axie Infinity, for instance, requires players to purchase three axie NFTs, which easily amounts to a few hundred dollars, in addition to downloading a crypto wallet. In an angel investors’ panel discussion I moderated, Jane Thomason, founder and CEO of Supernova Data, commented on these difficulties:

“If you’re not a crypto expert, [the process] is actually really hard: getting a wallet, buying ether, connecting to a platform, and bidding on a token. We have a long way to go with user experience and community education.” – Jane Thomason, Tech Coast Angels Panel Discussion

While the startup process can be prohibitive for new gamers, Jane also believes gamers will be the biggest adopters for crypto and NFTs.

Issues with NFTs

NFTs Take a Toll on the Environment

According to the 2021 Yearly NFT Market Report, 78% of NFTs are minted and sold on the Ethereum blockchain. Therefore, they require their native token (ETH) to be purchased on most marketplaces. Unfortunately, many ETH transactions have a substantial impact on the environment.

To mine (or “create”) ETH, a network of computers (the blockchain) essentially undergoes a trial-and-error computing process to solve highly complex equations. Blockchains that do this are called proof of work blockchains, and they are the main source of environmental strain. As “trial and error” suggests, the computational power expended does not guarantee any ETH mined, which leads to electricity waste. Bitcoin also uses proof of work, and a 2018 study published in Nature Climate Change found that Bitcoin emissions alone could raise Earth’s temperature by above 3 degrees Celcius within less than three decades.

The Cambridge Bitcoin Electricity Consumption Index estimates that Bitcoin mining uses more electricity than the entire country of Argentina. Image source: Shutterstock.

A working solution and replacement for proof of work has been proposed called “proof of stake.” The proof of stake process reduces the computer work needed to mine tokens, thereby reducing environmental impact. One of Ethereum’s current goals is to transition from proof of work to proof of stake.

In addition to proof of stake blockchains, other blockchain alternatives are on the rise. Immutable, a carbon-conscious blockchain, is partnering with GameStop to launch a $100 million NFT platform in 2022. Partnerships with socially conscious companies and proof of stake processes suggest that solutions to environmental concerns may soon be available.

NFTs Are Not User-Friendly

In addition to being bad for the environment, a survey of 28,000 people in 20 countries found an abundant lack of knowledge on what an NFT is:

“Despite their growth in popularity around the world, and the predictions that growth will continue in the NFT market, there are still a lot of people who aren’t familiar with NFTs and what they are; 90% of adults in Japan, 82.6% of people in Germany, and 78.8% of people in the United Kingdom stated that they don’t know what NFTs are. In addition, 70.6% of people in the United States and 70.2% of people in Australia aren’t sure about what an NFT is.” – Richard Laycock, NFT Statistics 2021

Similar to crypto, it is possible to interact with NFTs without knowing what they are. Many people view crypto as a volatile stock market and don’t understand its underlying use. Consumer-friendly marketplaces and games do not require an understanding of NFT mechanisms. Aside from theft, marketplaces provide a relatively pleasant user experience for digital artists; aside from crypto wallets, GameFi games are relatively easy to play and understand.

Entrepreneurs interested in truly disrupting the NFT space will need to do their homework. An understanding of the neighboring cryptocurrency environment is essential. There is also a great deal of jargon and plenty of terms to remember for new entrants: “token,” “blockchain,” “metaverse,” “mint,” and “gas fee,” as well as other terms still lacking concise definitions. Additionally, since NFTs and cryptocurrency are new, they are subject to unpredictable trends and industry-altering regulations.

Predictions

More Big-Brand Collaborations

NFTs are flexible. They can take the form of music, historic internet moments, metaverse wearables, and everything in between. Thus, 2021 saw strategic brand collaboration from a diverse pool of industries. NBA Topshot created an independent NFT platform and anchored sports content to a collectible series. Other companies chose less involved routes; Coca-Cola opted for a profile on Opensea and arbitrary NFT releases.

Image source: Defiance ETFs.

The ability for companies to induce the same sense of ownership and exclusivity as that connected to physical promotional items has proven to be a powerful marketing tool. As large corporations continue to develop precedence in the NFT space, 2022 will likely see more brands utilizing digital ownership and creating new strategies for integration and interaction.

Merging With Physical Assets

Although implementation may take more time than with digital assets, all NFT utilities are transferable to physical assets. New projects are already embracing blockchain technology as a means of changing physical-asset attributes.

A popular use case for physical assets is fraud protection. Since NFTs allow ownership to be recorded, it’s possible to authenticate luxury items—for example, based on their record of ownership. A sneaker connoisseur would be able to authenticate their shoes based on the factory record. This supply chain transparency can also apply to products linked to ethics concerns, such as coffee or wine.

Looking Ahead

NFTs use blockchain technology to provide uniqueness, trackability, and scarcity to digital assets. They are popular, if complicated. Artists, gamers, investors, and big brands have demonstrated interest in the technology.

As the dust settles from NFTs’ viral status, we’ll likely see environmental consciousness, IP protection, and more brand utility as remedies to scalability issues in the short term.

Christopher Yang is a member of Tech Coast Angels; a not-for-profit organization consistently ranked as one of the top five angel investment groups in the U.S. He is also VP of engineering at Onriva.